SME Mortgage Loan – INVESTMENT HOLDING COMPANY (IHC)

Everyone is talking about IHC nowadays for property investment.

What is IHC? Does IHC is suitable for you?

Consider that you are not well versed at IHC, Let us shed some light on this and share with you the GEM and POWERFUL TRICKS of IHC.

Why consider IHC?

1. Condolidating properties under personal name

2. No capping on mortgage loan margin

3. Under individual as guarantor, immediately can apply for mortgage loan financing upon registration of company

4. Under company as guarantor, need to have minimum two years audited report

5. For risk management

6. For taxation

Besides, for JV investment, IHC can be do better in handling the following risk management :

1. Death of any partner

2. Lawsuit againt any partner

3. Conflicts among partners

4. DSR (debt service ratio)

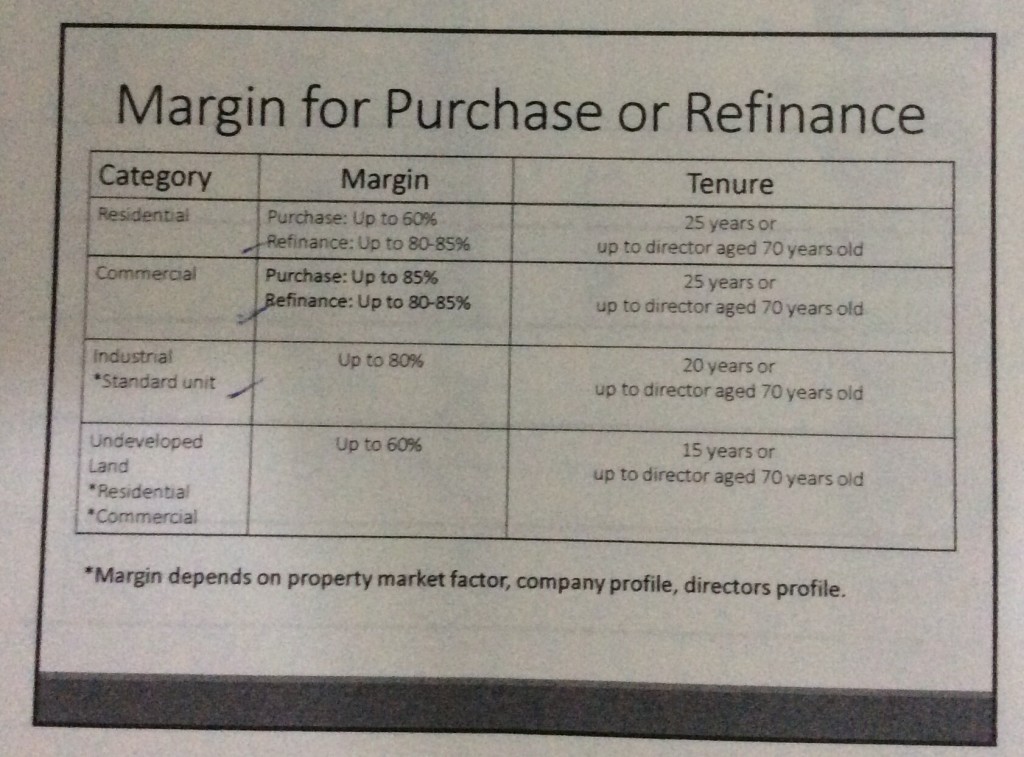

MARGIN FOR PURCHASE OR REFINANCE

Fee & cost involved:

1. Loan agreement fee and stamp duty

2. Valuation fee

3. Key man insurance/investment

4. Processing fee

For us, the above cost means nothing if there is alreafy equity in the existing properties for refinancing.

The only consideration point to set up an IHC for property investment is the annual maintenance cost of RM4k-5k.

What we found IHC IS REALLY POWERFUL TO UNSTUCK our loan eligibilty when:

1. Existing esidential under individual at LTV90% or LTV70%, which already no loan lock in period (usually 3 years) and properties already have equity under LTV 80% loan for current bank value (best if rental yield is at 6% as well based on current bank value), REFINANCE these properties to IHC with 80%-85% LTV!

2. Purchasing commercial properties, why?

Because of margin of finance is the at 80%-85% whether under individual or company.

Residential property

First property – LTV 90% (individual); LTV 60% (company)

Second property – LTV 90% (individual); LTV 60% (company)

Third property – LTV 70% (indovidual); LTV 60% (company)

Commercial property

First property – LTV 85% (individual); LTV 85% (company)

Second property – LTV 85% (individual); LTV 85% (company)

Third property – LTV 80% (indovidual); LTV 80% (company)

Furthermore, if the commercial property is a JV purchase, it is wiser to use IHC.

Eg, shop lot at RM1,000,000 (JV of 4 investors)

MOF 80% at RM800,000

20% downpayment : RM200,000

Investor A : RM100k

Share : 50%

Investor B : RM50k

Share : 25%

Investor C : RM20k

Share : 10%

Investor D : RM30k

Share : 15%

In IHC, share is transferable among investors.

In conclusion,

1. If were to buy residential properties, buy under individual name at LTV 70%-90%, wait until there is equity, then only refinance to IHC with LTV 80%-85%.

Which mean, the LTV90% quota will be made available again and DSR under individual profile will be made more qualify to purchase the next residential property.

2. If were to buy commercial, might as well use IHC.

As the individual DSR as guarantor under IHC will not connect to stand alone individual DSR, and vice versa; when apply for mortgage.

saw

Hi, can I have your email address/ contact no, want to about refinance to company 80% margin.

Thanks.

Sky

Chat Property Malaysia

AuthorBryan Lee

hi, i need to know more IHC, who can be assist.

Han Shee Nee

Need recommendion on co sec to set up IHC. And banker.

Contact me at 012 373 6672

sharmeela

Want to know more about investment holding?

Edward

Hi, I have a condo in Puchong, current market value around 420k, bank outstanding 240k. Current rental at 1350. Is under personal name. How to refinance to IHC for LTV 80% so I can cash out to buy another property?

Appreciate if you could contact me at ystan126@gmail.com

Chat Property Malaysia

AuthorHi Edward, you need to get it done through lawyer. Lawyer will advice you on the procedure.

Alex

Hi

Is that ihc must under sdn bhd ?

andersowc

Hi, may I know what is the process and how to open a IHC in Malaysia?

Will my friend from overseas be allowed to joint as well?

Steve lee

if tranfer my 2 property under IHC. Can i still purchase property borrow loan 90%0under personal name?

Chat Property Malaysia

AuthorHi Steven:

As long as the bank loan do not have your individual name,then is okay.

Michael Kum

Hi, thanks for the interesting and eye opening ideas and update. Please may I know what is the process and how to open a IHC in Malaysia?

My contact: kumkj1610@gmail.com

Appreciate and thanks.

Liew

Hi May I Know more about IHC in Malaysia law work?

I had a Condo around 10 Years and the price went up to 100% already and I have applied Re-financing or top up loan but Bank manager said I am a freelancer and salary not stable & bank will not approve my loan.

My Question: can I register a IHC to refinancing my property immediately?

Thanks

Tiu Chee king

thanks for the interesting and eye opening ideas and update. Please may I know what is the process and how to open a IHC in Malaysia?

My contact: ck8675@gmail.com

Appreciate and thank

Patty

Hi

Can advise me for my current property should refinance under personal or IHC?

Pattylai.51@gmail.com

0127237741

Chat Property Malaysia

AuthorHI Patty:

It all depends on your strategies.

JoyLing

Hi I want to know more about how to open investment holding company.please contact me ?

Andy Seng

Hi…i wanna to know more on IHC knowledges.

Got class to attend ?

My contact is 0179988998 😉

Chat Property Malaysia

AuthorHi Andy:

You may search around as we do not have any class.

Noob investor

Can foreigner set up IHC & buy a residential at selangor below rm2mil?

Chat Property Malaysia

AuthorHi:

Do more research on this area for foreigner.I do not have any experience

Marcus Lee

Hi i would like to learn more on ihc. Can you please contact me. My email lee1328@gmail.com

Jafni

Hi. I have enquiry regarding the procedure to transfer property from individual to IHC company. It would be a pleasure if you can contact me through email jafni91@gmail.com or Whatsapp 019-7991949 (Jafni)

Ck

Hi..I m ck lim..I would like to learn more about ihc,Whatapps 0125286551

Christopher lim

May I know what is the difference between IHC and Sdn bhd? Me and 2 of Patner intend to my shop lot or commercial property . My accountant ask us to open a Sdn bhd but not Inc.

sean sim

Can i how the the pros and cons between company vs individual holding a shoplot or shoplot(s) ?

felix teh

1) How to setup IHC in M’sia?

2) What minimum capital amount to setup for IHC setup?

3) How many stake-holder or investor is allow in IHC?

4) What is in vantage or disadvantage between IHC or Sdn Bhd?

5) What is Fee & cost involved:

1. Loan agreement fee and stamp duty

2. Valuation fee

3. Key man insurance/investment

4. Processing fee

5. Secretaries Fee

Ben Lim

Hi I would like to transfer my unit to IHC . Can I know the procedure of doing it..

my email : opptsb@yahoo.com

0127096325

Hope can get more info and advise from you soon..Appreciate it..

eric chia

good morning

Eric Seet

I got some doubt.If buy residential properties, buy under individual name at LTV 70%-90%, wait until there is equity, then only refinance to IHC with LTV 80%-85%.However IHC only can get LTV 60%only. Pls advise

Chat Property Malaysia

AuthorHi Eric Seet:

All are depending individual needs and analysis of pro and cons.

Elvin

Hi,

How to transfer individual property to IHC? Please advice

Andy

How to get loan using IHC?pls advise

Chow

How to setup IHC in Malaysia?

What means IHC ?

Fee IHC ?

Prema

Hi I would like to know more about setting a IHC company..please do email me pammgmt2914@gmail.com

OandaRogers

I have always relied on my investment holding company as this way I can pay lower taxes for my investment. You can hire a property consultant to explain to you more about it.