Last night before going to bed, one of my poly mate send me an Whatapps message claiming he will be able to change more Ringgit now.

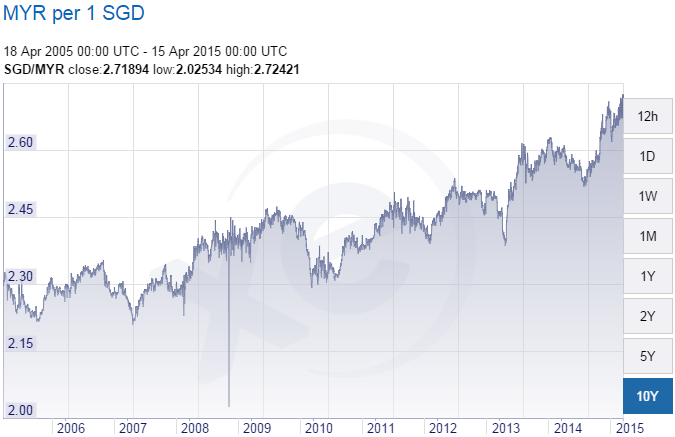

The exchange rate for 1 SGD to 2.72 MYR. It is the highest record and broke the MYR 2.70 resistance.

I moved back to Malaysia for good in May 2004. At that time, the exchange rate is about 1 SGD to 2.20 MYR at that time. Singapore dollar has appreciated to 2.72 MYR for past 11 years. Refer to the Chart 1 for the trend. Anyone will love to see this chart as it is climbing steadily all the time.

Singapore dollar is appreciating 1.95% annually for the past 11 years! Is it good? I am not very sure as I am not studying FOREX trend at all.

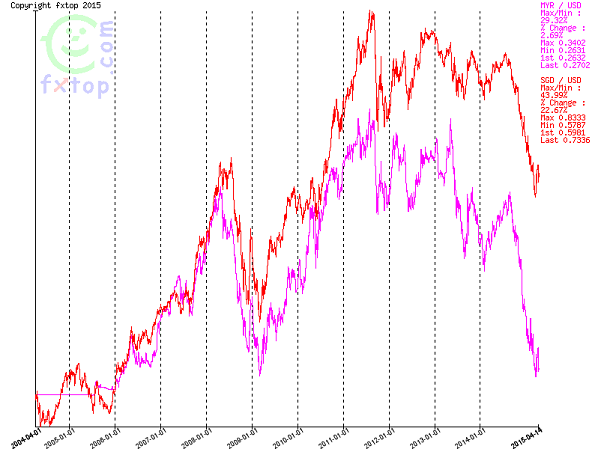

Quickly I check online on the past 10 years trend for SGD and MYR. Chart 2 is extracted from fxtop.com which able to compare 2 currencies at same time.

From the Chart, it is clearly depict that the gap between SGD and MYR is wider now compared to 10 years ago.

Let me analyze from a normal people like me. My friend saying that it will be good to park the money in Singapore dollar rather than in Malaysia. It maybe true but I am not convinced on myself.

When I moved back on the day to Malaysia, I am really happy as I loved Malaysia lifestyle and less stressful environment. At that time, I do have SGD 10,000 saving in my POSB bank account. Let me do a quick calculations and do a comparison.

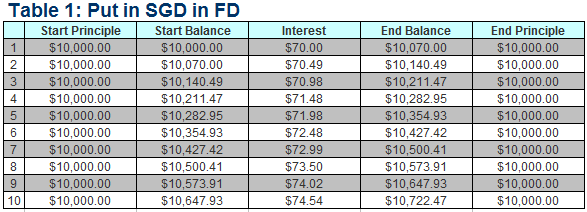

Scenario 1: Put in the SGD Fix Deposit

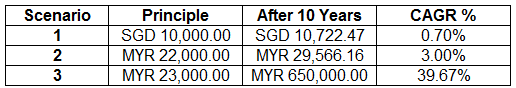

In 2004, I have saving of $10K SGD and keep in the bank with interest rate 0.7%. After 10 years, I will have $10722 SGD according to the below Table 1.

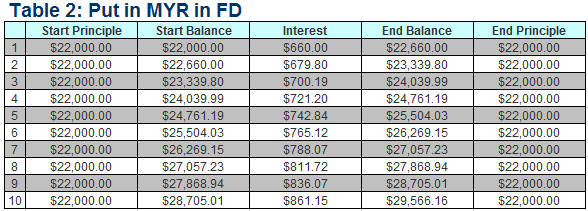

Scenario 2: Put in the MYR Fix Deposit

Scenario 2 is I changed back SGD 10K to MYR with exchange rate of 2.20. I will have MYR 22,000 and keep in the bank with interest rate of 3.0% (Conservative). After 10 years, I will have $29566 MYR according to the below Table 2.

Which one is better now? Put in Singapore bank or Malaysia bank to safe guard the currency fluctuation? Let us take the money that keep in Singapore bank after 10 years and changed it to MYR.

Exchange rate today SGD/MYR= 2.72

SGD 10722 = MYR 29163.84

With today exchange rate of 2.72, Will have MYR 29163.84

Comparing MYR 29163.84 with Scenario 2 which is MYR 29566, keep money in Malaysia bank will have additional MYR 402 more. For me, it is insignificant. So it does not matter where you put money in Singapore or Malaysia even MYR is depreciating along the time.

Scenario 3: What I actually did?

Above just a simple illustration which my friend and I debate over this for a while. He also surprised to know the result at the end of the comparison. When I moved back to Malaysia and wanted to settle down, so I start to look for property so that I can buy for my own stay. At that time, I am not financial savvy. What I want just a roof over my head.

In 2005 I booked a medium cost apartment near USM area called Desa Airmas. It is priced at $ 230,000 and required $23,000 down payment. It was just nice that I can take my SGD 10,000 and exchange it to MYR for my down payment. Remember, I bought it for my own stay and never think of any form of investment. This could be from our parent mindset that we need to buy our own house as young as possible. I am financial ignorant at that time.

Based on the article on Desa Airmas, the current priced at Desa Airmas is command at $640,000 till $660,000. The compounded annual growth rate for Desa Airmas, is yielding at whopping 11.12% p.a

With this, what will be the best choice? Of course Scenario 3 giving the best return. I summarize it at below table.