When you heard the statement “build you retirement through properties portfolio”, do you know exactly what it is about? I bet many of you not able to comprehend it well. Let go through this topic in more details. I called it retirement fund become retirement wallet. The wallet contains money for us to spend during our golden years.

Define your retirement wallet amount

When you are retired from your career, there will be no more monthly salary paid to your account. But your wallet still need to pay your daily expenses such as food, transportation, entertainment etc.

First you need to calculate how much fund in your wallet in order to sustain your life when you are retired, assuming that you have no more debt such as personal loan, housing loan and car loan. Your children all are grown up an no longer dependent on you. What you need is the amount to sustain your lifestyle you would like to live comfortably during your retirement years.

Remember to calculate in your spouse expenses as well. You may want to factor in the inflation if you would like too. However, for this context, I will omit out the inflation rate for now.

So what will be your retirement expenses per month?

Anyone will have different number as each of us having different lifestyle. Below is the example of two different lifestyle and expenses for illustration purpose. For example, Jaime and his wife only need $3000 expenses per month to maintain his lifestyle. Whilst Sonia required $5000 per month.

Case Study for Jaime:

For Jaime case, he needs $3000 in his wallet for his monthly expenses. This is pretty easy to achieve as Jaime only required to have $1,000,000 cash and put into bank with interest rate of 4% p.a, Jaime will be having enough money in his wallet every month.

You may ask, where to get $1 million cash? Remember that everyone can become millionaire as long as you start saving on your first month of your career till you retired.

Put $1,000,000 into Bank

Interest rate = 4%

Yearly Interest paid = $40,000

Each month = $3,333

Case Study for Sonia:

Now let’s study how could maintain Sonia lifestyle by having $5000 per month. If following Jamie case above by putting money into bank and use the interest to sustain monthly expenses, Sonia required to have $1,500,000 in her bank account. There is $500,000 short fall from the initial million dollar saving plan. Frankly I am not able to save that much of money. As such, for Sonia has to use alternative plan which is building up rental properties portfolio.

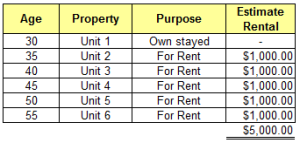

According to the “previous post” you can generate $5000 per month from your 5 rental properties. It just assuming that each of the rental unit able to give you positive cash flow of $1000 per month.

Cash flow for each Rental Property=$1000 / month

Total 5 units = $5000 / month

The best part of the rental property is you can increased your rental according to the inflation rate. With this it will not affect your lifestyle along the way. It is just as easy as ABC.

Bear in mind that for Sonia, she not yet utilize her saving as well as her EPF fund.

When I quote Sonia example to others, I said that Sonia having 3 wallets, one is her saving wallet, EPF wallet and rental wallet. She just need to choose which wallet to use when needed.

Choose your retirement wallet and work on it now.