Normally when you want to plan for your retirement fund, the most conventional way of doing it is to calculate how much is your monthly expenditure. Then also forecast your life expectancy. in anybody who will doing financial planning for you, they ask below 3 questions:

- When do you want to retire?

- What is your future monthly expenses after retired?

- What will be the forecast life expectancy?

Question 2 is the hardest to predict. No one can predict its own life at all. So how do we forecast? Below will be the two scenario with the forecast if life expectancy is 80 years old:

| Scenario | Life Expectancy | Retirement Fund | Remarks |

| 1 | < 80 years old | Excessive of fund | In heritage by family members |

| 2 | > 80 years old | Deficit of fund | Depending on family members for pocket money |

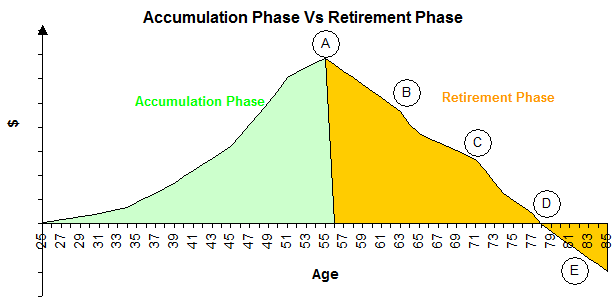

Scenario 2 is the worst as required to depend on family fund to live on. Below is a simple chart separating the Wealth Accumulating Phase and Retirement Phase.

We start the wealth accumulation at the age of 25 until age 55 years old. Point A is the retirement age start. The fund will be depleting from that day onwards since there is no accumulation activity going on. When reach Point B, which your one of your son need to borrow money from you for new car down payment, you will need a lump sum for it. Several years later, your daughter need a down payment for her new house and required to borrow money from you again, that is Point C. Now you will feel that your retirement fund is reaching empty now. By the time you reach 80 years old, all your retirement fund is finished, which is Point D. From then onwards, you will be required to live in Zone E which need to depend on your other family members to support your living expense now.

From investment point of view, the retirement fund should not be dried up. The investment vehicles/instruments that used should be keep giving you the cash flow, regardless how long is the life expectancy. I prefer this kind of vehicle. For instance, when retired, I would like to have $10,000 for my monthly living expenses. As far as I know, there are two investment vehicle able to achieve the goals, namely:

- Invest in high Dividend Stock company

- Invest in Rental Properties

I am not competent to elaborate on the Strategy 1 which is invest in high Dividend Stock company. As for Strategy 2, I will elaborate on the next post.